Do you want to make money from your Sui assets without selling them? Sui Lending protocols enable you to do just that by letting you earn interest on your tokens while keeping them secure. It’s like putting money in a savings account but with much better returns.

The Sui blockchain has three popular platforms where you can lend your crypto: Navi Protocol, Scallop, and Suilend. Each one works differently and pays different rates. In this article, we’ll help you pick the best one for you. By the end of this guide, you’ll know exactly which platform will make you the most money and which one is easiest to use.

How We’re Comparing These Platforms

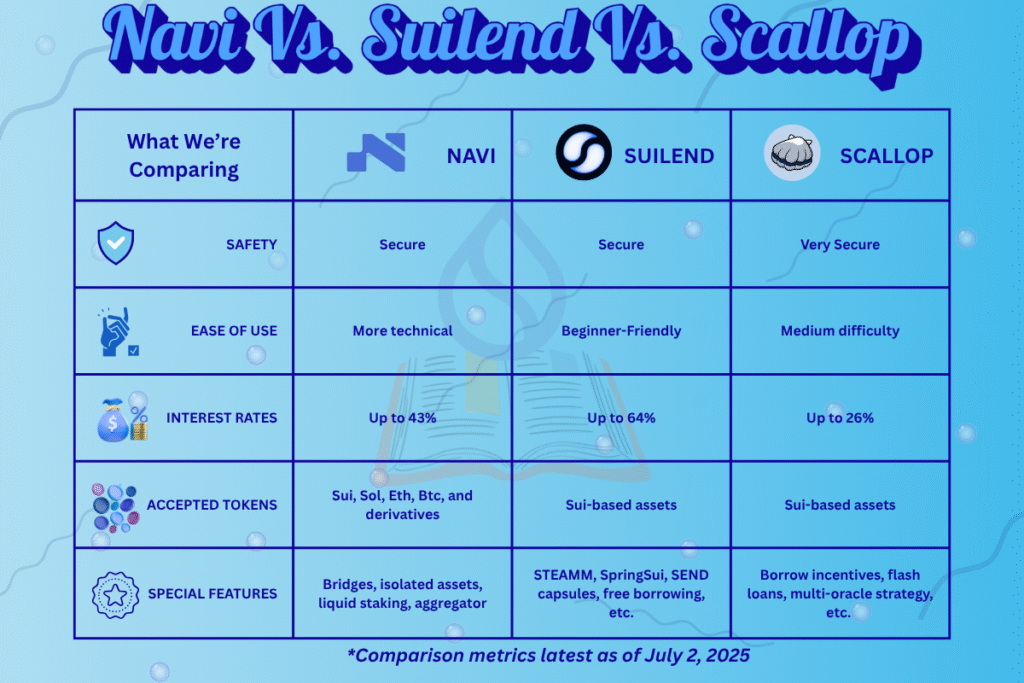

To make our comparison original, we’re looking at five important things that matter when choosing where to lend your crypto:

- Safety: How secure are your assets? Has the lending platform ever been hacked?

- Easy to Use: Is the lending app beginner-friendly or confusing?

- How Much You Earn: Which platform pays the highest interest rates?

- What Coins They Accept: Can you lend the coins you own?

- Special Features: What extra benefits do they offer?

Towards the end of this article, we’ll share a table that gives each protocol a simple rating so you can see which one wins in each category.

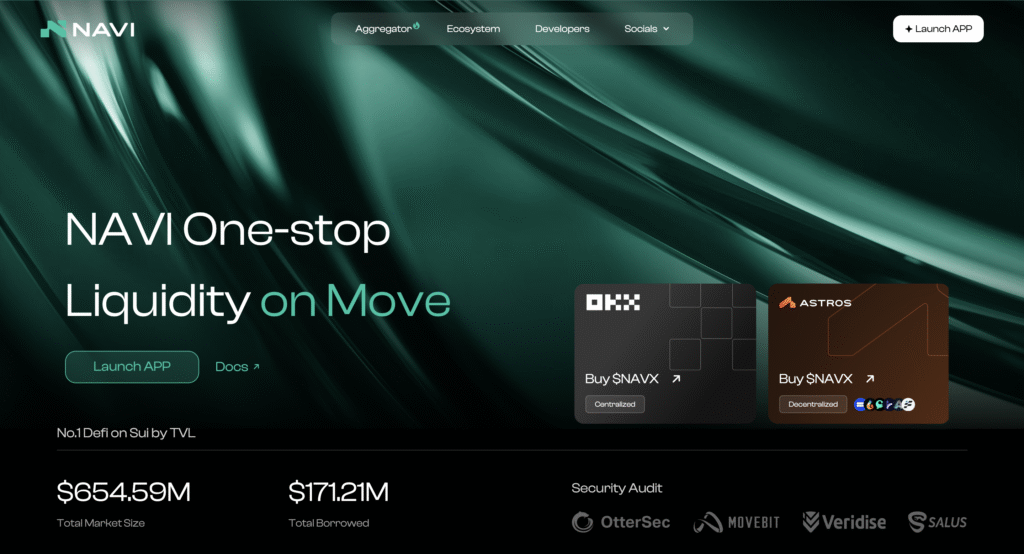

Navi Protocol: The Swiss Army Knife

What It Is

Navi Protocol is like a financial superstore for your crypto assets. Instead of just lending money, you can do many different things all in one place. It’s built by experienced DeFi builders from Apple and other respectable industries. This helps bring Silicon Valley expertise to Sui’s ecosystem.

Think of Navi like a bank that offers checking accounts, savings accounts, loans, and investment services all under one roof. You don’t need to visit multiple websites to handle your crypto money.

What Makes It Special

- All-in-One Platform: Lend money, borrow money, trade coins, and more without leaving the site

- Bitcoin Support: One of the few places where you can earn money from Bitcoin on Sui (through something called xBTC)

- Professional Grade: Built for both regular people and big companies

- Many Coin Options: Supports popular coins like SUI, USDC, USDT, SOL, ETH, and BTC.

- Advanced Tools: Offers fancy features like lending assets migration, liquid staking and leveraged farming (a way to potentially earn more, but with higher risk).

Pros

- Lots of different ways to make money from your crypto.

- Strong team with experience building successful platforms.

- Keeps adding new features and coins.

- Works with other blockchains, not just Sui.

Cons

- The website can feel overwhelming for beginners.

- Newer platform, so less proven than others.

Perfect For?

People who already know about crypto and want lots of different ways to use their coins. Also good for businesses that need professional-grade tools.

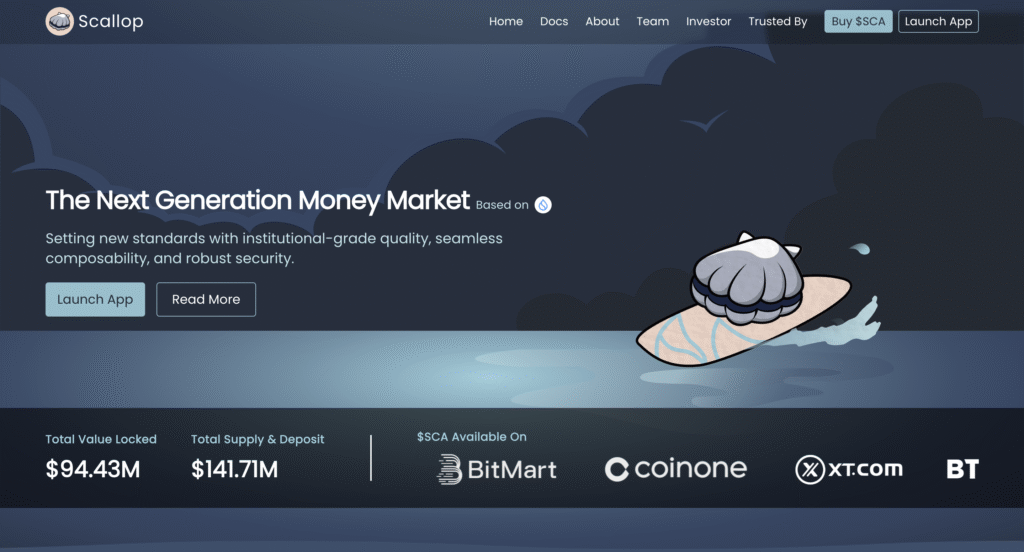

Scallop: The Trusted Favorite

What It Is

Scallop is like the oldest, most trusted bank in Sui crypto town. It was the first lending platform that the Sui Foundation officially supported with money and backing. Launched in 2021, Scallop has been around longer than most crypto platforms. They’ve handled over $15 billion in lending and borrowing, with over $90 million TVL (Total Value Locked) as of July 2, 2025.

What Makes It Special

- Official Backing: First protocol to receive official Sui Foundation grant, ensuring strong ecosystem backing.

- Proven Track Record: Over $130 million in current user funds and 4 years of successful operation.

- Loyalty Rewards: Users can stake SCA tokens to earn bonus rewards (like a VIP membership).

- Extra Security: Uses special technology that keeps your lending money separate from borrowing collateral.

Pros

- Official support from the Sui Foundation gives extra confidence.

- Long history of success with billions in volume.

- Rewards program for loyal users who stake tokens.

- Very secure design that protects user funds.

- Large community of satisfied users.

Cons

- You need to buy and lock up SCA tokens to get the best rewards.

- Borrowing costs recently went up from 0.1% to 0.3%.

- SCA tokenomics might confuse crypto beginners.

Perfect For

People who plan to use the platform long-term and don’t mind buying SCA tokens for better rewards. Great for users who prioritize safety and official backing.

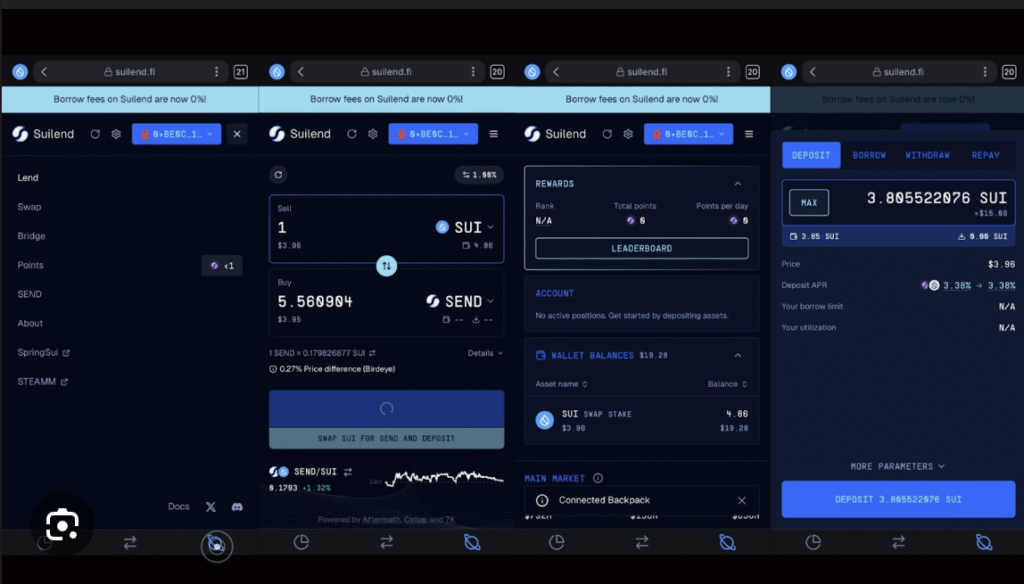

Suilend: The Simple Choice

What It Is

Suilend comes from the team that built Save Finance (previously called Solend), one of the most popular lending platforms on the Solana blockchain. The Save Finance platform serves over 170,000 users and has a TVL of over $200 million. This expertise has proven beneficial for Suilend as it currently has a TVL of over $500 million, the highest in the current Sui ecosystem!

Think of Suilend like a user-friendly bank app. It focuses on making lending and borrowing as simple as possible, without confusing features or complicated rules.

What Makes It Special

- Experienced Team: Created by people who already run a successful lending platform.

- Built for Sui: Designed specifically to work perfectly with Sui blockchain technology.

- Beginner Friendly: Clean, simple website that anyone can understand.

- No Complications: No special tokens to buy or complex reward systems.

Pros

- The Suilend team has already proven they can build successful lending platforms.

- The platform is extremely easy to use, perfect for beginners.

- Built specifically for Sui, so it works smoothly.

- Borrowing is currently completely free.

- Has recently incorporated SpringSui (a liquid staking token) and STEAMM (an Automated Market Maker)

Cons

- Newer to Sui compared to established competitors.

- Fewer fancy features than other platforms.

Perfect For

People new to crypto lending who want the simplest, most straightforward experience. Great if you just want to lend your coins and earn money without complications.

Our Recommendations

If You’re New to Crypto Lending

Choose Suilend. It’s the easiest to understand and use. You can start earning money from your crypto without getting confused by complicated features. The team already runs a successful platform, so you know they’re trustworthy.

If You Want the Most Options

Choose Navi Protocol. It offers the most ways to make money from your crypto. You can lend, borrow, trade, and even earn from Bitcoin. Perfect if you like having many choices and don’t mind a slightly more complex interface.

If You Plan to Use It Long-Term

Choose Scallop. If you’re willing to buy their SCA tokens, you can earn extra rewards. Also, having official Sui Foundation backing means they’re likely to stick around and keep growing.

For Specific Needs

- If Want to earn from Bitcoin: Navi Protocol is the strongest of the three in terms of Bitcoin-backed loans

- Want maximum security?: Scallop has various unique security features as well as official Sui Foundation backing.

- Want the simplest experience: Suilend (designed for beginners)

- Want highest earnings: Depends on whether you’ll stake tokens (Scallop pays more if you stake, others pay similar rates)

Bottom Line

All three platforms are good choices, but they serve different types of people:

- Scallop is the established leader with official backing and proven success.

- Navi offers the most features and ways to make money from your crypto.

- Suilend keeps things simple and easy for newcomers.

Your best choice depends on how comfortable you are with crypto, whether you want simple or advanced features, and if you’re willing to buy platform tokens for extra rewards.

Remember: crypto lending always involves risk. Only lend money you can afford to lose, and always do your own research before putting your coins on any platform.